If you want to earn more, you need to work more; if you earn more, you would work less. Confused? Welcome to the world of economics of labour. Labour market puzzles have become integral part of the working of labour markets across the world. They never fall short in supply, and in fact, new puzzles keep arriving before old ones get solved thereby making the day to day functioning of labour markets very complex. One of the persisting puzzles is the labour productivity and its relationship with wages. The economics of labour delves deep into these real world puzzles that every labour market confronts with and try to give some realistic answers.

Image Source: The pencil sketch is by Mr. Swapnajit Das, UG Semester II Student of the Department of Economics, Adamas University.

Labour is just another commodity that is traded in the market having its own demand and supply. So, questions may arise, like why do we need to treat the economics of labour or labour economics as a special field of economics to be studied? Why don’t we have specialization in economics for every commodity, such as Chocolate Economics, Computer Economics, and so on? The simple reason behind treating labour as a special sub-area of economics to study is the importance of labour market and the complexities associated with it.

How hard is it to estimate wage of a potential labour market participant? Determination of wage rates is just at the centre of the economics of labour given the puzzles surrounding it. We invest in human capital with the expectation that it would generate higher returns that otherwise. But, how much this expectation is valid in the real world? Do the incomes of individuals really match their productivity always? Not really. Given the wage rate, how much leisure would you really like to sacrifice against labour? All these questions do not have simple answers.

Given the corona hammered present economic scenarios, we must say that had the labour market functioned so smoothly following the simple rules of demand and supply, then the restoration of economic activities with the least possible negative effects would have been possible, the migrant workers crisis would not have surfaced in such a horrific way, and their future would not have been such doomed.

Many youngsters may now want to explore the working of economy looking at the present economic crisis to build their own opinions and may wish to voice those opinions. Their opinions would really matter a lot as they are the future and the future of the economy will be lying in their hand. You can raise valid questions, you may even work as strategy makers and so on, but for all these you need to understand how labour market works, and hence, Labour Economics is designed as a special paper/course while studying Economics.

To understand the income distribution and who is earning what and why, you need to understand labour market and the economics of labour exactly deals with it. As a commodity, labour has a number of special and peculiar features which have significant implications in the determination of wages and optimum quantity to be employed. You may have same productivity as one of your friends, but you two may not get similar wages/salaries. Like any other product differentiation, labour is also differentiated in term of its intrinsic features as well as some socio-demographic and cultural properties and all these have their implications in wage determination. Consequently, people may not get paid based on their productivity and that is why the determination of the price of labour, i.e. wages/salaries, is a complex task.

How does Labour Economics help solve the labour market puzzles?

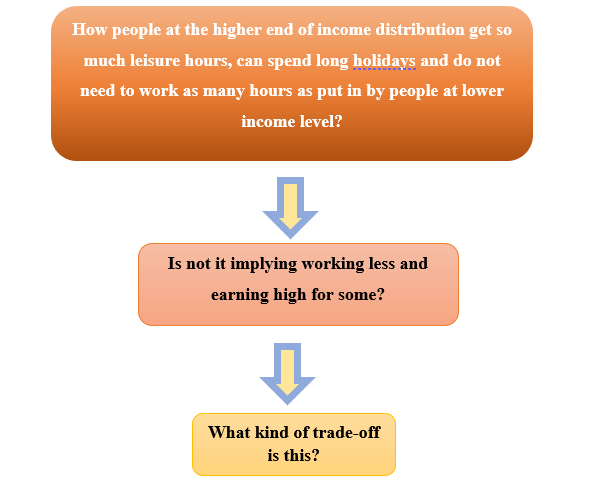

Have you ever thought of –

This is one of the real word riddles called labour leisure trade off, and it is the Labour Economics that make you go in depth of this puzzle and get the answer. One may also see how this trade off varies from one person to the other depending on their own features.

Labour Economics that revolves around various theoretical models based on different assumptions related to real world activities also forms the basis of empirical investigations that have been being conducted by the researchers across the globe since several decades to understand wage determination processes and labour market participations. These research studies offers necessary insights about the effectiveness of different labour market policies and other economic policies in enhancing individuals’ wellbeing.

If you want to be a part of India’s economic strategy making endeavours actively or passively, and wish to offer your contribution even in its smallest capacity in pulling our economy out of this crisis, then you need to have a solid understating of how labour market works as it is the market where people generate their incomes. Economy would collapse if its labour market becomes dysfunctional. This manifests itself the importance of the economics of labour. This special field of economics is designed in such a way that it offers answers to various real world riddles surrounding labour market processes.