Despite increased energy access in developing countries, 789 million people all over the globe remain in the dark. COVID-19 has had an impact on the market, in particular as it has led to reduced demand, financial stress and disruptions in the power supply chain.

Power sector is one of the key driver’s of the global economy which supplies electricity to all other sectors. In times of crisis, such as the pandemic, we are witnessing in 2020, reliable electricity supply has become essential for sustained medical services and working remotely under lock-down conditions, among other aspects of our modern daily lives. The power sector consists of generation, transmission, and distribution. Traditionally, power was generated by burning hydrocarbons and harnessing hydropower. However, in recent years, the share of power generated from renewables such as wind and solar has grown, thanks to declining costs and concerns about global warming. Generated electricity moves through transmission lines that are as extensive as highways—power crosses international borders and is traded on global markets. Once the transmission lines reach users in industrial, commercial, or residential areas, the distribution network takes over and delivers electricity to the end consumers. A handful of corporations (or state agencies) operated power plants and networks before the 1990’s. However, many countries across the globe have unbundled their electricity utilities — separating generation, transmission, and distribution, which has facilitated industry investment in the private sector, increased demand, and lowered electricity prices. Added to the mix is research on the regulatory environment that has become essential to building trust among investors, maintaining fair pricing and promoting renewable energy, conservation and efficiency.

Impact

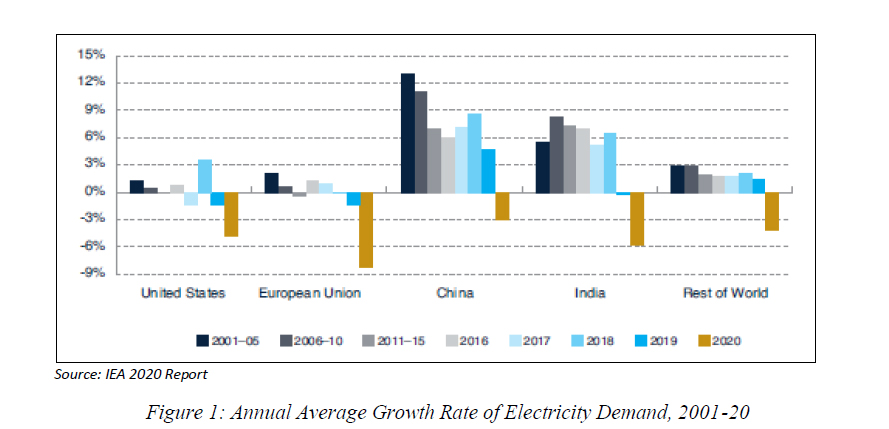

Lockdown initiatives have greatly decreased the demand for electricity in both the commercial and industrial sectors over the past few months. The International Energy Agency (IEA) reports (fig. 1) that global demand for electricity dropped by 2.5 per cent in Q1 2020 and expects a 5 per cent fall by the end of the year. In March and April 2020, a 15 percent drop in demand was observed. Slower growth in demand as a result of falling COVID-19 led economic activity would likely hold oil prices down. Nonetheless, we should anticipate volatility. Low oil prices would benefit oil-importing nations, particularly those where oil prices are linked to natural gas. Despite the economic downturn in China and record shale gas production in the United States, natural gas prices were already at historic lows before COVID-19. Spot prices in countries with a significant share of renewables reached rates close to zero marginal costs (for example, at certain hours in Brazil, Mexico, Peru and Turkey).

According to estimates, the downturn in demand led to cleaner air with an expected drop in carbon emissions in April by 17 per cent compared to a year earlier. Contributing to this is declining factory production, less cars on the road and less power generation. In addition, global renewable energy generation increased by 3 per cent, powered largely by new online solar and wind projects over the past year. Under current conditions, the sustainability of renewable energy offers a clear hope for potential increased demand and investments in renewables.

Growing energy demand can also be met as economies rebound from COVID-19 by ramping up the generation of thermal power plants, which will increase carbon emissions. If fossil fuel prices remain small, renewables, particularly in countries with large hydrocarbon endowments, may potentially be squeezed out in the medium term. On the other hand, low gas prices are now helping make gas-fired power generation relatively more attractive in comparison to carbon-intensive, coal-fired power generation.

Increasing unemployment due to the pandemic may prevent many people from paying their electricity bills. The payment delays and delinquency of utility bills by end-consumers (residential, commercial and industrial) is beginning to have a detrimental effect along the energy supply chain. In many countries, governments have intervened by maintaining electricity services to the population during the lockdown while also reducing the negative financial impact on the sector.

Lower power demand and pressures on end-consumer bills limit distribution companies’ ability to compensate power suppliers under long-term, take-or – pay power buying (PPAs) agreements. Many power distribution enterprises need substantial and immediate liquidity support. This is a major concern for investors who rely on PPAs to recover and make a return on their investments.The drop-in demand in more liberalized markets has resulted in the fall of the electricity market rates, hurting power generation firms.

Globally, many companies across different sectors have ceased or decreased capital expenditure and the power sector is no exception where possible. Non-critical investments around the sector — from generation to transmission to distribution — were suspended.

Supply chains are also affected for the power sector. Some power sector equipment manufacturing is moving into a sharp slowdown. On the positive side, China’s COVID-19 situation, where most of the solar supply comes from, is normalizing, and factories are beginning to re-open. Supply shortages from other countries impact the wind industry more strongly than solar (which relies on foreign supply linkages). In addition, local and international travel restrictions, quarantine requirements, and lockdowns resulted in project delays and added to the construction costs of the project.

Way Forward

The COVID-19 pandemic has caused the power sector to suffer multiple dislocations. Nevertheless, as the pandemic eases and mobility increases, it is possible that economic activity will take off. It will increase commercial and industrial energy demand, which will alleviate many of the problems facing the crisis. While governments attend to the significant funding needs emerging from COVID-19, among other pressing objectives, the private sector will play a vital role in providing the major investments and expertise needed for the power sector in developing countries. International organizations with a long history of financing power projects internationally, mobilizing partner support and a deep partnership with governments and local stakeholders will continue to make a major contribution to the sector’s growth. In the future, the aim in the electricity sector is to help countries in creating cost-competitive power markets that foster sector resilience, inclusiveness and the role of renewables.