What is Mutual Fund?

In times of enhancing need and mobilization of domestic savings in lucrative investments, the importance of mutual funds have increased significantly. Mutual fund acts as a financial intermediary by pooling up the savings of small and large income earners and help these investors in deriving the benefits of capital market advancement. This intermediation between the suppliers and customers of financial resources gains importance globally on account of attractive returns with reduced risks.

The Mutual Fund industry in Indian economy has been developing constantly since its inception. Its Assets Under Management (AUM) has been experiencing a radical increase from only Rs.25 crores in 1964 to Rs.23.93 lakh crores till April 2020.

Why not invest in Mutual Funds during Post COVID 19?

Since the outbreak of COVID-19 in India, the global contagious disease caused by coronavirus in January 2020, the stock markets have experienced an extensive crisis with severe dampening effects in the entire global scenario. This has affected the Indian Mutual Fund Industry as well.

Due to the lockdown announced by the Indian Government, the economy has got slower and will continue to remain slow over the next few months. For most businesses, the slowdown can be in the form of supply disruptions, fall in consumption demand, and stress on the banking and financial sectors.

The equity markets have seen an unprecedented sell off across the board in the last few months. This sell off has been occasioned by the rapid spread of the pandemic in several countries and therefore, some disruption was expected to happen in the major global economies. Such disruptions affect economic growth, output, aggregate demand and supply, employment and a host of other key macro-economic variables. The adverse impact on these variables results in lower income for households, unemployment, and also lower earnings for companies. It is this chain of factors that caused the selloff thereby magnifying the probability of a global economic slowdown.

Several factors also highlight that the Indian Mutual fund sector is not at all worthy for investment in the present Post COVID 19 scenario:

(i) New Fund Offers (NFOs):

NFOs by mutual fund houses have been dwindling since the outbreak of COVID-19 largely due to the nationwide lockdown and its impact on overall investor sentiment. The number of NFOs was 11 in January, 6 in February, and it further dropped to just one in March and nil in April.

(ii) AUM of Indian Mutual Fund Industry

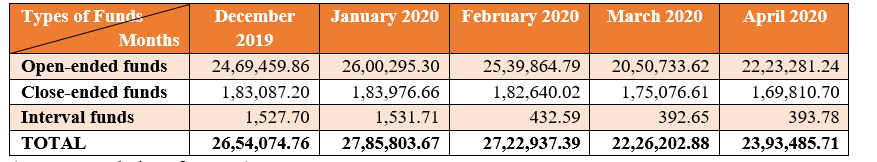

The total AUM of the Indian mutual fund industry declined by 9.82% between December 2019 and April 2020 due to COVID-19 effect. The AUM of open-ended mutual funds decreased by 9.97% during the same period. Moreover, assets in equity-oriented mutual funds declined by 3.5% between December 2019 and April 2020 due to COVID-19 effect. That apart, assets in equity-oriented mutual funds recorded a continuous decline from February 2020 to April 2020. However, it is noticed that assets in debt-oriented mutual funds and liquid funds increased by 2.2% and 0.8% respectively between December 2019 and April 2020 due to COVID-19 effect.

Table 1: Growth of AUM in the Pre-COVID and Post-COVID 19 scenario (Rs. in crores)

(Source: website of AMFI)

(iii) Retail Participation in Mutual Funds:

The share of individual investors in mutual fund assets declined continuously between December 2019 and April 2020. On the other hand, the Indian mutual fund industry witnessed an increase in the share of institutional investors in mutual fund assets continuously from December 2019 to April 2020.

Table 2: Share of Individual and Institutional Investors in Mutual Fund Assets (%)

|

Month |

Individual Investors |

Institutional Investors |

|

December 2019 |

53.4 |

46.6 |

|

January 2020 |

52.7 |

47.3 |

|

February 2020 |

52.7 |

47.3 |

|

March 2020 |

52.2 |

47.8 |

|

April 2020 |

52.1 |

47.9 |

(Source: website of AMFI)

(iii) Debt Fund crisis on account of COVID-19 outbreak with reference to Franklin Templeton Mutual Fund:

The reason for debt fund crisis in Franklin Templeton Mutual Fund was dramatic and sustained fall in liquidity in certain segments of the corporate bonds market on account of the COVID-19 and the resultant lock-down of the Indian economy. Franklin Templeton invested in lower quality papers/instruments for generating more returns. Lower rated papers usually have very low liquidity as they cannot be sold immediately in the market at a fair valuation in India.

This incident shattered the confidence of the entire debt mutual fund investors, who rushed to withdraw their investments from credit funds as well as other debt MF schemes.

(iv) Mutual Fund Returns:

As per statistical data on Mutual Fund returns obtained from Mutual Fund Insight report 2020, it has been observed that amongst debt funds, mid-duration, short-duration, ultra short-duration and credit risk funds performed better in the pre-COVID period. Surprisingly, long-duration debt funds and dynamic bond funds performed better in the post-COVID period.

Post-COVID returns of all equity funds except pharmaceutical funds were negative in 3-month and 1-year. Amongst equity funds, large-cap funds, international funds, pharmaceutical funds and technology sector funds generated positive returns in the post-COVID period in 3-year. 5-year and 10-year post-COVID returns of all equity funds were positive barring infrastructure funds which generated negative returns in the 5-year period.

Thus, the market fall was like a financial cyclone that waved away the faith and stability despite miscellaneous liquidity measures taken by the Government of India. The markets were worried on account of lack of clarity in near future. This led to massive fluctuations in the markets, which in turn affected the Indian Mutual fund sector. Again, with the sudden shut down of six debt funds of Franklin Templeton, the investors’ fear grew up with increased lack of confidence about the way forward.

However, this tough realism of drastic phase will again be overcome with boom in near future as soon as this pandemic moves out with invention of coronavirus vaccines with reduction in number of affected and deaths along with the implementation of several innovative government policies.