Pertains to the following courses

- Monetary Economics in M.A. (Public Policy) Programme

- Financial Institutions and Regulatory Systems in M.Sc. (Quantitative Finance) Programme

- Financial Institutions and Markets in M.Sc. (Economics) Programme with specialization in Banking and Finance

In the emerging economies COVID19 caused escalation in poverty-incident because of job-loss on the one hand and one other hand accretion of disposable cash coupled with erosion of purchasing power attributed to both of lesser opportunity to spend and lower return on investments caused by suspended real production. This means on the one hand the blue collar workers and small scale entrepreneurs are suffering from crunch in inflow of money and on the other hand a relatively sizeable chunk of workers of gold, white and open collars, and middle and large scale entrepreneurs are finding money less and less useful because of inflated prices of the small size of production of necessities permitted by the governments pari passue with shrunk interest earnings. Here arises the issue of peoples’ faith on money.

Money is a part and parcel of our daily life. It is a medium of exchange/payment, measure of value, store of value and so on. It is also considered as a good to buy and sell in the market but unlike other goods the charter of supplying money is vested with a single or few agents permitted by the monetary authority or government. As a medium of payment money is connected to the price level and as a store of value, money commands a price called interest rate. In the interest of smooth macroeconomic management the monetary authority frames and implements certain policies called monetary policy involving changes in money supply that has repercussion on price levels and changes in certain interest rates that has repercussions on investments and real productive activities and changes in exchange rates between the home currency and the reference currencies.

In a globalized economy money to a layman means generally fiat money backed by the sovereign. The faith of the public on money is largely because of the sovereign charter and the efficacy of the institutional mechanism governing (i) creation, use and channels of flow of money, (ii) balance between inflation and unemployment in the domestic economy and (iii) exchange rates and balance of payments in the external sector. Though the monetary literature has grown out of the contributions starting from the field of political economy since Plato’s time till today by a host of other disciplines including banking, finance and institutional economics, this growth could not save the first word from hyper inflation and the third world from hunger and famines.

Chaos and catastrophes in the regulated monetary system as witnessed in USA and East Asia in last two decades and hyperinflations in government money in Germany in 1923, Greece in 1944, Hungary in 1946, Zimbabwe in 2008 etc portrayed a shade of suspicion about the success of government money as an asset. This suspicion combined with various restrictions imposed by central banks on select activities like gambling, money laundering, tax evasion etc through mandatory KYC (know your customer) or similar norms for banks worldwide gave rise to search for some alternative to government money. The result of the search is the birth of digital currency. Digital currency is an internet-based medium of exchange for goods and services. Such transactions occur on the internet instantaneously and allow borderless transfer of ownership. There is no currency conversion from one nation to another. The digital currency can be defined as entries in a database that can be changed only after certain verified transactions. Money in one’s bank account represents a verified entry in a database of accounts, balances and transactions. Through gradual evolution of vocabularies, the terms ‘digital’, ‘virtual’ and ‘crypto’ are used as synonyms. The terms ‘money’, ‘currency’ and ‘cash’ are also used synonymously in this context. It appeared first in the form of bitcoin in 2008. It has become so popular as medium of exchange that there are online platform for shopping using bitcoin.

The fun of crypto currency is that it does not need a supplier central bank and there is an upper cap on the supply of a crypto currency imposed by technological constraints. As a result, the interest rate will increase as demand will increase but the success of bitcoin bond launched on the Bloomberg platform during this July 2019 is yet to be seen. There are multiple suppliers of private digital money – bitcoin, ethereum, XRP etc are among the popular. Secondly, the technological character of crypto currency is that a unit of crypto currency cannot be spent two times, i.e. the transaction velocity of crypto currency is unity only. Thirdly, inflation of crypto currency cannot be controlled by the conventional monetary policy by targeting interest rate or otherwise in absence of a central bank. Though no government has attached any official status to crypto currency, yet bit coin futures are traded in leading international exchange houses like Chicago Mercantile Exchange.

The pandemic is likely to escalate the popularity of crypto currency among those who can access the digital currency market because of public fear of handling cash and coins and visiting banks and ATMs (automatic teller machines) and the opportunity to earn interest through a digital currency market. The same may not be true in an emerging economy because a sizeable population is not financially included nor does everybody financially included possess computer and computer-literacy but launching of crypto currency will surely spell away the opportunities for rent seeking, illegal payments and siphoning away funds targeting the public welfare in a developing economy because a crypto coin can’t be spent more than once. So a monetary authority may experiment launching an official crypto currency without dismantling outright the extant money at the initial stage in the form of medium of exchange and payments only, but not as an investment product. However this measure may widen the gap between the privileged and under-privileged in terms of access to technologically advanced payment systems.

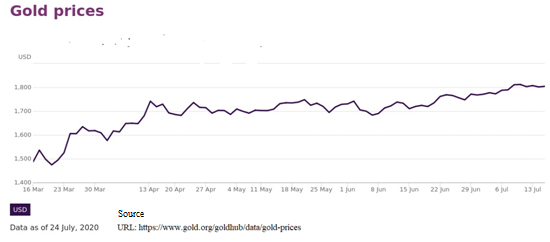

A funny guess is that, if one is not comfortable with sliding USD in the real market as depicted above, then lending USD against any crypto currency like BTC is also not profitable because excess supply of USD will virtually pull down interest rate in this insecure loanable fund market. Acceptance of a crypto currency is backed by certain community’s faith but not any real asset. Be aware of hacking of $400,000 worth XLM coins and $534 million worth NEM coins and beware!

Visited 1534 times, 1 Visit today