Who is a Cost and Management Accountant (CMA)?

CMA, a reputed designation like Chartered Accountant and Company Secretary, has a pivotal role in strategic business management. CMAs are such who, in addition to focusing upon optimum utilization of available funds, also need to take strategic decisions for meeting the sustainability goals of the company. Unlike mere Accountants, CMAs not only focus on cost estimation but also on cost reduction; while assessing operational efficacy in production and service-related operations. Through implementation of modern technology, CMAs advise on optimum product mix; and identification and mitigation of business risks. So, Excellence combines with multifaceted Accounting and Managerial skill, along with Advanced Technology in the role of a CMA.

Institute of Management Accountants (IMA) defines four major roles of CMAs as “Steward, Operator, Strategist and Catalyst” in their Global Salary Survey 2021. They mentioned the following:

- “Stewards are responsible for safeguarding a company’s assets and ensuring compliance with financial regulations and external financial reporting.

- Operators provide services like financial planning, treasury and tax to run an efficient finance organization.

- Strategists are financial leaders that align business and finance strategies for the future of the business.

- Catalysts execute new strategies related to a business’s finance function.”

How can one become a CMA?

A student needs to pursue CMA Course to become a CMA. This professional Course can be pursued from India (as offered by the Institute of Cost Accountants of India) or abroad (US CMA- offered by IMA). In India, there are three levels for completion of CMA Course- Foundation, Intermediate and Final. The entire process for pursuing CMA Course from ICMAI is given by means of flowchart below.

However, a candidate can also pursue US CMA, which is globally recognized, from IMA. Such a Course can be completed with a minimum of 6 months to 3 years. The candidate needs to get enrolment in CMA Program as a member from IMA website and register for the exam. The candidate needs to pass the Exam in 2 levels with a minimum of 360 marks out of 500. Further, there is no requirement of Article ship in US CMA as that of 6 months for CMA India.

Why become a CMA?

Demand for CMAs increases magnificently with the rapid industrial growth, owing for increase in demand in strategic business decisions and value creation. On account of involvement of modern technologies in business world, there lies a strong need to have certification which can build up a professional propensity for the competitive age. CMA certification increases employable skills through practical and industrial exposures.

For this reason, there becomes a rapid expansion of career prospects for CMAs as evidenced from increasing demand for Financial Managers, Financial Analysts, Chief Financial Officer, Financial Research Associate, Financial Controller, Corporate Controller, etc. by the Top MNCs. Not only in the Corporate, CMAs are also high in demand in the academic institutions in teaching cost and management accountancy. Further, CMAs also engage themselves in providing cost related consultancy services.

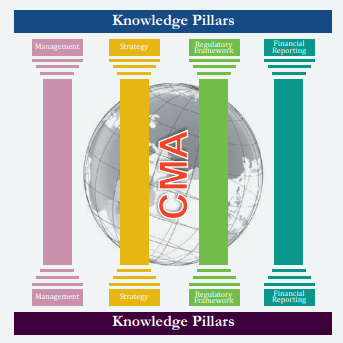

The competences developed at the CMA profession ranges in the following way:

- Constructing Cost efficacy.

- Business Analytics Strategy and Sustainability

- Auditing & Assurance

- Product pricing and Business Valuation

- Cost Benefit Analysis

- Firm Governance

- Efficient Regulatory Landscape

- Benchmarking

- Cost and Management Accounting

- Management of Finance.

- Management of Direct and Indirect Taxes

- Management Control Systems

As per Indian Express 2021 report, around 500 newly qualified CMAs were recruited by Top companies like Accenture, Philips, ITC, GAIL, TCS, L&T, etc. Such remarkable growth in demand was also evidenced by 40% hike in highest CTC offered by Accenture as compared to that of highest CTC in 2020. Not even that, the average CTC was also around Rs.10 lakhs per annum (30% hike as compared to that of 2020).

As per IMA Global Salary Survey report 2021, the mean compensation for the CMAs in India in 2021 were $ 29,685 as against $ 19,439 for non-CMAs. Even the mean salary for the CMAs was also increased in 2021 ($14,096 to $15,000).

Henceforth, aspiring candidates can enhance their core competences through getting a CMA certification; thereby getting distinct career opportunities and earn lucrative salary in the global business world.

APJ Abdul Kalam, Former President of India said “If we have to succeed in the globalized world, we have to enlarge the scope of Cost Audit to cover all aspects of manufacturing and service sector activities including healthcare and education.”

Visited 737 times, 1 Visit today